How do convertible notes work? – StartupSmart

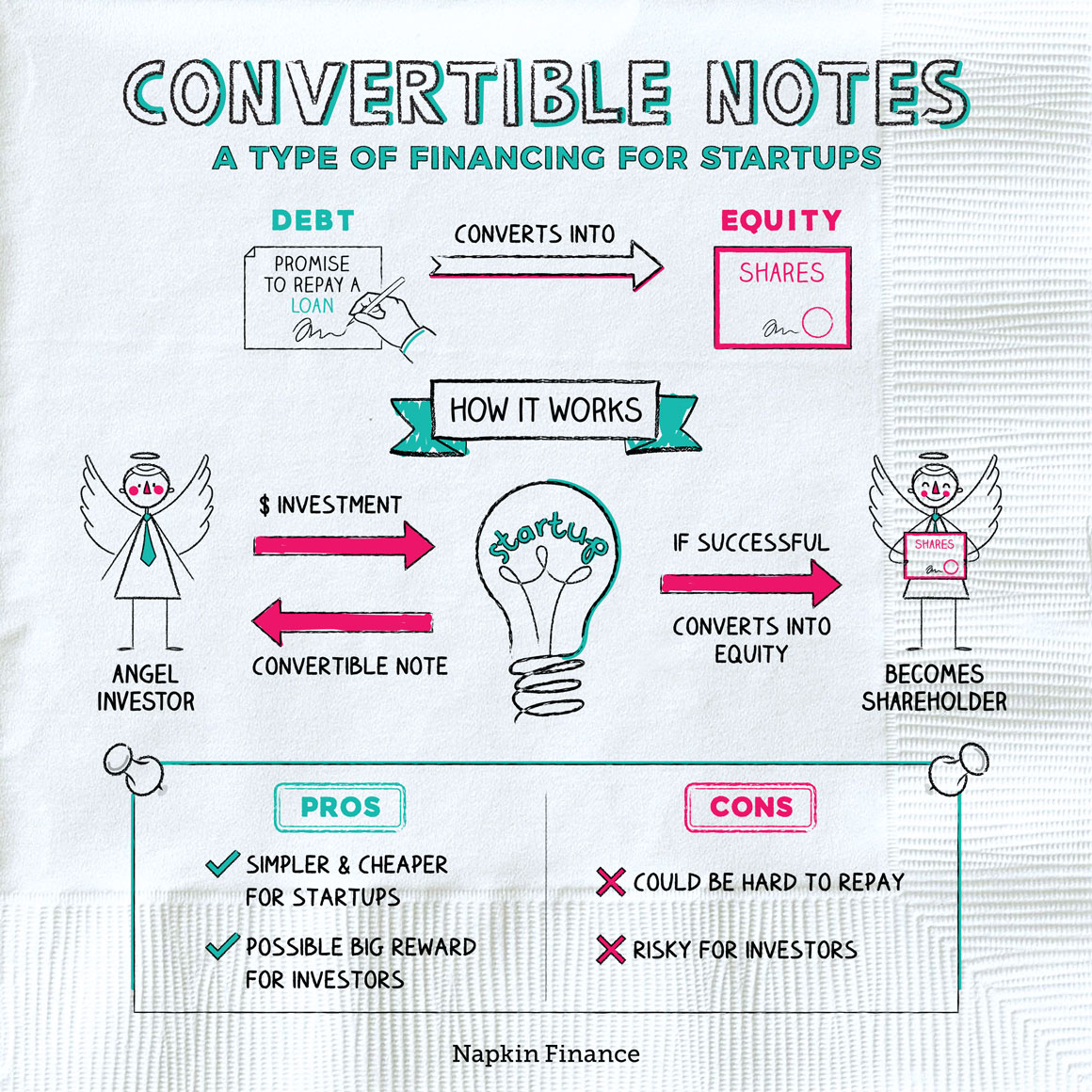

Startups often raise their first round of capital using a convertible note structure. A convertible note is a debt/ equity hybrid structure which, if well structured, is a flexible, simple and cost-effective way to raise a seed round.

This article gives a brief explanation on the basics of convertible notes. It’s the second in a series of articles written by the LegalVision team on capital raising for startups.

Why use a convertible note?

Valuing an early stage startup is difficult. Negotiating a valuation with investors is time consuming and often leads to deals falling through. By raising capital through a convertible note, a startup can delay valuing the business until more data is available and the size of the raise warrants a thorough negotiation process.

Secondly, convertible notes are usually relatively simple documents. By using market standard documentation, both the startup and its investors can avoid spending large amounts of money on lawyers to draft and negotiate the documentation.

How do they work?

If an investor uses a convertible note to invest in a startup, the startup immediately receives the funds; however, the number of shares the investor will be entitled to will only become clear when a pre-determined trigger occurs (usually the raising of a ‘Series A’ round).

The idea is that, by then, the startup will have some traction and the venture capitalists leading the Series A round will be in a better position to negotiate the valuation. Once the Series A pre-money valuation has been negotiated, the convertible note will convert into equity at a pre-determined discount to the Series A valuation as compensation for the additional risk taken on by the convertible note holders.

It’s important to note that until the convertible note converts into equity, it is classified as debt.

How much equity will an investor receive for the convertible note?

This really depends on the price of the Series A round, as well as two other factors:

- Discount rate: This determines the extent to which the noteholders are reimbursed for taking on extra risk by investing before the Series A round of investment. The discount rate will generally be set at between 20% and 40%.

- Valuation cap: This is another method of rewarding seed investors for their early-stage investments. The valuation cap establishes at what (maximum) price the convertible note can be converted to equity in the company at. A valuation cap protects investors. If a startup does particularly well between the seed round and the Series A round the convertible note holders effectively receive their shares at a much higher actual discount rate.

What is the relationship between the discount rate and valuation cap?

Convertible notes will typically convert based on either the discount rate or valuation cap – it depends on which of the two gives the investor the higher price.

If your startup is negotiating your first convertible note, try and avoid having a valuation cap. A valuation cap can act as an anchor on your Series A pre-money valuation.

What are the interest rate and the maturity date?

- Interest rate: Since convertible notes act as a debt instrument prior to conversion, they all include an interest rate. Instead of paying out cash at the interest rate, the startup will pay the investor in shares once the note is converted. If an investor were to invest $10,000 into a new startup by using a convertible note that had a 2% interest rate, upon receiving Series A investments a year later the investor would have accrued $200 in interest. This means that the investor will be able to convert the $200 into shares at the applicable rate of conversion. Interest rates on convertible notes can be anywhere from 0% to 10%.

- Maturity date: The maturity date on a convertible note tells the entrepreneur (start-up) when the note must be repaid. If a startup can’t raise any funds in a Series A round of investment, or is already making enough profit, the note will convert into ‘X’ amount of shares. Valuation at the maturity date will normally be calculated based on a multiple of revenues at the applicable date.

What makes a good deal?

It’s not always easy to work out whether the terms of a convertible note are reasonable without having some experience in startup investing. Speak to entrepreneurs and investors with experience in the convertible note space. They’re not that common in Australia so make sure you speak with someone who knows what they’re talking about!

Lachlan McKnight is the CEO of LegalVision, online law firm that provides startups and SMEs with cost-effective, fixed-fee legal advice. LegalVision has raised capital through a revenue loan structure, and Lachlan has invested in a number of startups using convertible notes.

Follow StartupSmart on Facebook, Twitter, and LinkedIn.