Convertible notes and priced rounds – StartupSmart

There has been some debate lately about two forms of investment structure used by VCs, namely “priced rounds” and “convertible notes”.

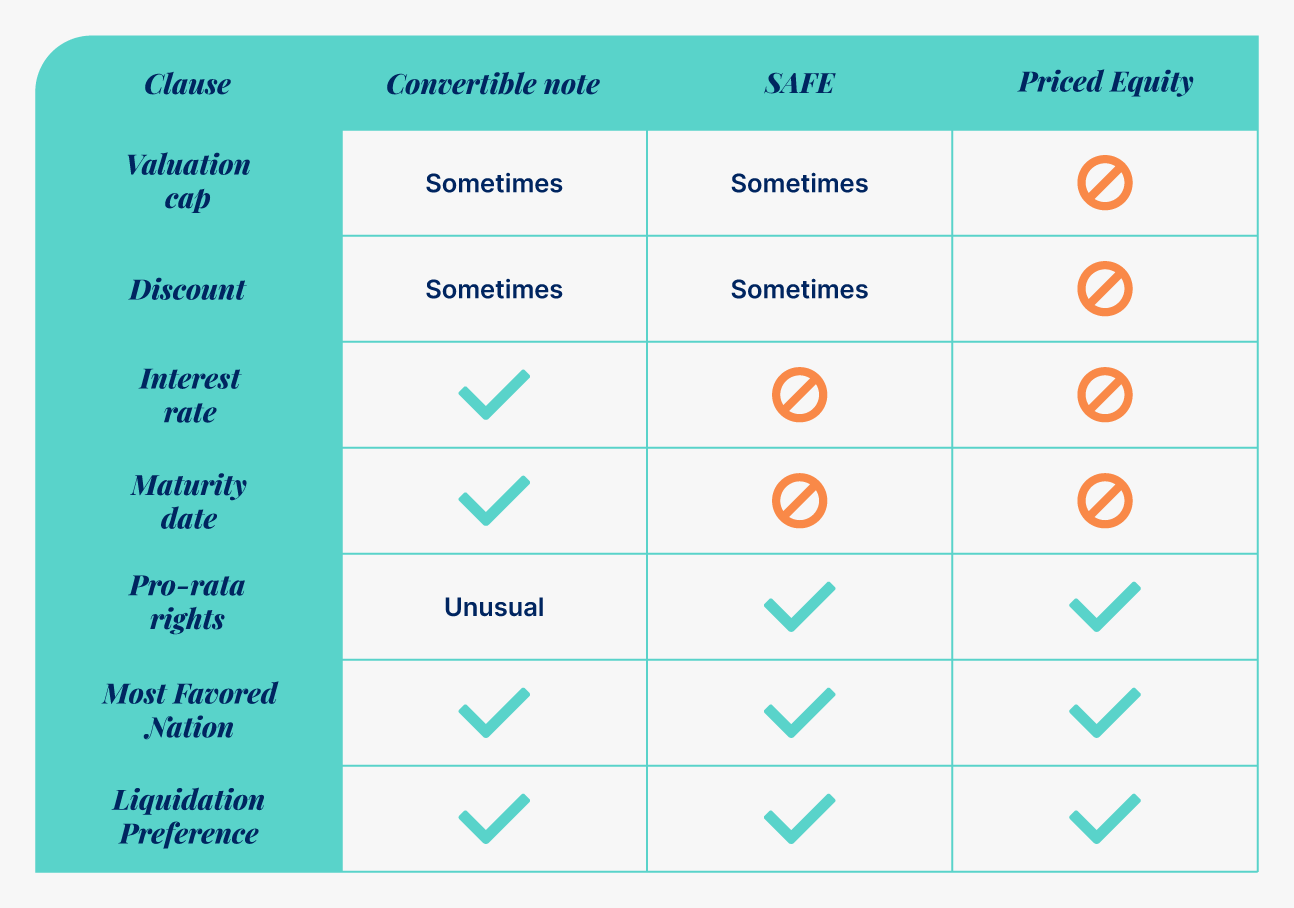

At its simplest, in a “priced round”, each investor in a funding round is told the price per share and is issued shares at that price. Meanwhile, a convertible note is a type of loan that converts to equity when the next round of funding is closed, usually with some form of discount.

Fred Wilson first posted about it on Saturday, then Dave McClure chimed in, followed by Mark Suster via another blog post.

I found this conversation interesting as it provided insight into how these experienced VCs structure their investments.

I wasn’t sure how many deals were based on notes versus how many were priced. When Fred said he had never invested via a convertible note I felt very reassured as I recently declined such a deal.

The reason I don’t like convertible notes is because they do not align entrepreneur and investor.

There is a tension that one side might end up better off than the other and the note incentivises you to make short-term decisions to bolster valuations for the next round which might not be the right strategy for the business over the long term.

We recently received a term sheet from an investor which proposed a convertible note. As an entrepreneur, it is difficult to be aligned with an investor on such terms that could result in losing vast amounts of equity if things take longer than expected.

While founders will have their own views, I value alignment over valuation.

Convertible notes with ratchets don’t represent an alignment of interests. If you want to build a billion dollar valuation over the long term, founders and investors need to see eye to eye.

My view is that a priced round is the only way to achieve alignment if the founder prefers this.

To quote Fred in point #2: “I don’t understand why folks don’t understand it.”

The excuse that investors use is that “it is hard to value a start-up, so let’s leave this to the next round once you’ve got some traction”. However, start-ups are not meant to be valued traditionally as there are usually little or no cashflows from the outset.

Investors need to back the idea, the market, the vision and the team and figure out what funding is needed to realise this vision.

If the opportunity ticks the right boxes then the next step is to work out how much is needed, how much the founders are prepared to part with, set a 1x liquidation pref, and get started. The valuation should be based on what the founder needs, and how much they are prepared to part with.

I wouldn’t sleep as well at night knowing that I might end up parting with 40%, 50%, 60% or 70% of the company if we don’t reach specific milestones quickly.

If I was on the other side of the table as Fred is, I’d rather the founders I invest in focus on product and the business rather than have the stress of knowing they could lose equity over the long term.

The reality is that businesses are not built overnight and that many of the consumer internet business that are worth billions today never had a revenue model when they started out – Google, Twitter, Facebook, etc.

A convertible note with a ratchet is nothing but a ticking time bomb, especially if you don’t yet have a revenue model. Founders need the breathing room to figure things out and the right investor will appreciate this.

Our business does have a revenue model but it’s still a new product and we need to market it and get it out there and that can and will take time. I’d rather build the business without a ticking time bomb under my seat and with the peace of mind that I know where I stand, and that means an equity deal.

Start-ups should not be about financial engineering.

They should be about software engineering and marketing. Founders deserve to have the peace of mind that they can get on and build their product and business. In my view, the only way to ensure the founder’s full attention is focused on building company value is by pricing the equity up front if that’s what a founder wants.