Can I claim business expenses for my fledgling start-up on my regular job tax form? – StartupSmart

I have a business registered under my name.

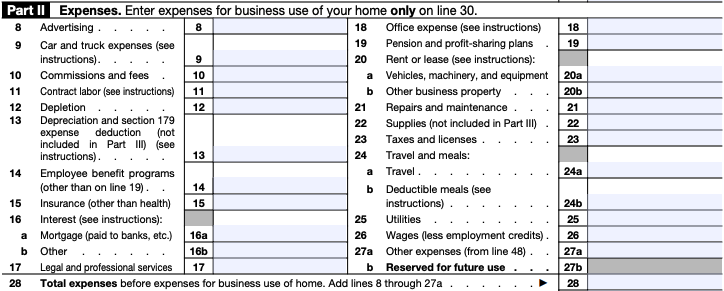

However, I have no clientele as yet, therefore no income, but have outlaid money for insurance and advertising.

Can I claim it on my ‘normal’ job tax form, as I am also employed?

The ATO has the following strict rules that have to be passed in order to offset your business losses against your normal income.

If you can answer yes to one of the following then you can offset those losses against your group certificate income:

- Your business is a primary production business or a professional arts business and you make less than $40,000 (excluding any net capital gains) in an income year from other sources.

- Your loss was solely due to a deduction claimed under the small business and general business tax break.

- The ATO allow you to offset the loss under a Private Ruling based on your circumstance.

- Your income for non-commercial loss purposes is less than $250,000, and either your assessable business income is at least $20,000 in the income year; the business has produced a profit in three out of the past five years (including the current year); the business uses, or has an interest in, real property worth at least $500,000, and that property is used on a continuing basis in a business activity (this excludes your private residence and adjacent land); the business uses certain other assets (excluding motor vehicles) worth at least $100,000 on a continuing basis.

I’m assuming your business is not a primary production business and you have not requested a private ruling in the following to help you track through these questions.

So firstly, your income from your normal or group certificate income has to be under $250,000 before we can go any further. If you pass this, we move onto the next question.

Did your business turn over $20,000 or more for that current year? If you answered yes and all your expenses from the business create a loss, then you can offset this loss against your normal income.

If you can’t answer yes, then the loss from your business will need to be carried forward to next year until you make a profit and use this loss to offset that business profit or until you pass this test.

If you said no, you can go to the next questions to see if you can pass these tests. If you can’t, then your loss will again need to be carried forward to future years.

Remember you only have to pass one of the four above and not all of these tests.