How do I plan for succession without creating a family feud? – StartupSmart

I’m looking to hand my business onto the next generation one day. I have three kids – how can I best handle it legally so that the assets are split fairly and there aren’t any disputes?

Transitioning a business from one generation to the next is one of the more difficult things confronting a family business.

There are not only the financial, legal and practical matters to consider, but also the emotional issues that make the discussions much more difficult.

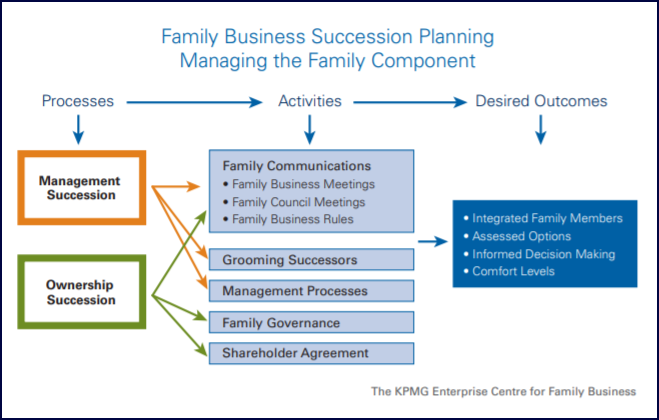

The three elements to successful transition are:

- Transitioning the management of the business.

- Transitioning the ownership of the business.

- Determining the spread of ownership and management between family successors.

This last point is often exceptionally difficult.

Transitioning the management of the business

Before embarking on any transition it is important to have an appropriate corporate structure in place. You need to see your lawyer and perhaps accountant in relation to this.

The next step is to sit down with your family members to work out a transition plan including these considerations:

- Will you have an ongoing involvement, say, as a chairman or consultant to the business?

- Will all members of the family be involved?

- Will some members of the family be passive investors and not have any entitlements?

- Who will do which jobs?

- Will shareholdings (ownership) be divided equally?

- Will everyone be paid the same if they are employees?

- Will they be paid according to their position?

In making these decisions, it is important to have a very clear understanding of the roles that your successors play in the business. Consider whether they have been involved in the business over a period of time and gained a certain level of knowledge and if they will they need external advice.

Part of the planning process should start a number of years from the intended transition date. This will enable the successors to build their experience and expertise and their relationships with employees, customers and suppliers.

During those preparation years you can evaluate the performance and gauge the relationship between the successors. This will give some understanding as to whether the succession strategy will actually work.

In my experience, these practical matters are the most important in any strategy and plan for succession.

Transitioning the ownership of the business and determining ownership/management

This issue requires both legal and accounting/taxation advice together with commercial and practical factors. On the assumption that there is a corporate structure in place, then shares in the business will be transferred to the successors.

It is strongly recommended a shareholders’ agreement is entered into between the successors to avoid conflict.

Shareholders’ agreements are relatively long documents that set out the rights of and relationship between the shareholders of the company.

They deal with issues such as decision-making and dealing with disputes, dividend distribution, selling and issuing further shares, structure of the board, management’s powers and limitations and so forth.

The issue of shares does not have to occur at any one point in time, you can issue over time so that the transition period is gradual, which can have some advantages going forward.

3. Some do’s and don’ts

Do’s:

- Plan the structure and transition.

- Pay the successors according to their performance but reward them by dividends according to their share ownership.

- Get legal and accounting advice.

- Try to make the transition gradual over a period of time.

- Make sure there is a dispute resolution procedure.

- Enter into a shareholders’ agreement with all parties.

- Make the decisions in relation to transition collectively but ensure you give guidance and have a very clear view yourself before you start the process.

- Train your successors.

- Develop the transition plan well before it is needed – start talking about it early.

- Be fair to all members of your family in terms of ownership, but not necessarily in terms of management or control of operational decisions.

Don’ts:

- Be totally driven by taxation benefits.

- Make decisions about successors unless you are convinced that they not only want to succeed you in operating the business, but they have the ability to succeed you.

- Proceed without a plan and a fundamental understanding between all involved as to how the transition will occur.

- Be too quick to let go of the reins of the business – be sure you train and encourage people and act as a mentor.

- Dictate the direction of the business post-succession – let your successors have the influence they desire. You will have difficulty at times when they wish to take the business in another direction, if they wish to take the business in another direction, but this is usual. You will have to let go at some period of time.

It is a fact that only around one-third of family businesses survive longer than five years post-transition. If you don’t plan and carefully implement the transition strategy, the chances of the transition surviving will be quite small.

This was written on James Omond’s behalf by Leanne Scott, senior lawyer, Carter Lawyers.