Is cash flow killing your business? – StartupSmart

Eighty per cent of businesses fail because of cash flow problems. Regardless of how profitable you are, or how many investors you have lined up, it’s vital you know how to manage your cash flow so you have a clear idea of the financial health of your business.

Kate Gibson, ANZ General Manager Small Business Banking, shares her money-smart tips on cash flow.

Understand how much working capital your business needs to run

Working capital – the money needed for the day-to-day running of your business – needs to be managed closely. It is essential that you time your debits and credits so that you have enough to cover your expenses each month, advises Gibson.

- Review your debtors: Have you credit checked your new customers? If you’re not being paid in on time, develop good engagement processes such as providing accurate quotes and detailing payment terms.

- Speed up invoicing and your collections cycle: Are you slow to issue invoices, or still writing paper invoices on the spot? Cloud-based accounting services or apps can help you generate and send invoices on the spot to get customers paying more quickly.

- Take stock and review your inventory: Avoid holding stock or buying more than you need by checking stock levels before ordering.

- Review your suppliers – take a look at your current terms and consider re-negotiating.

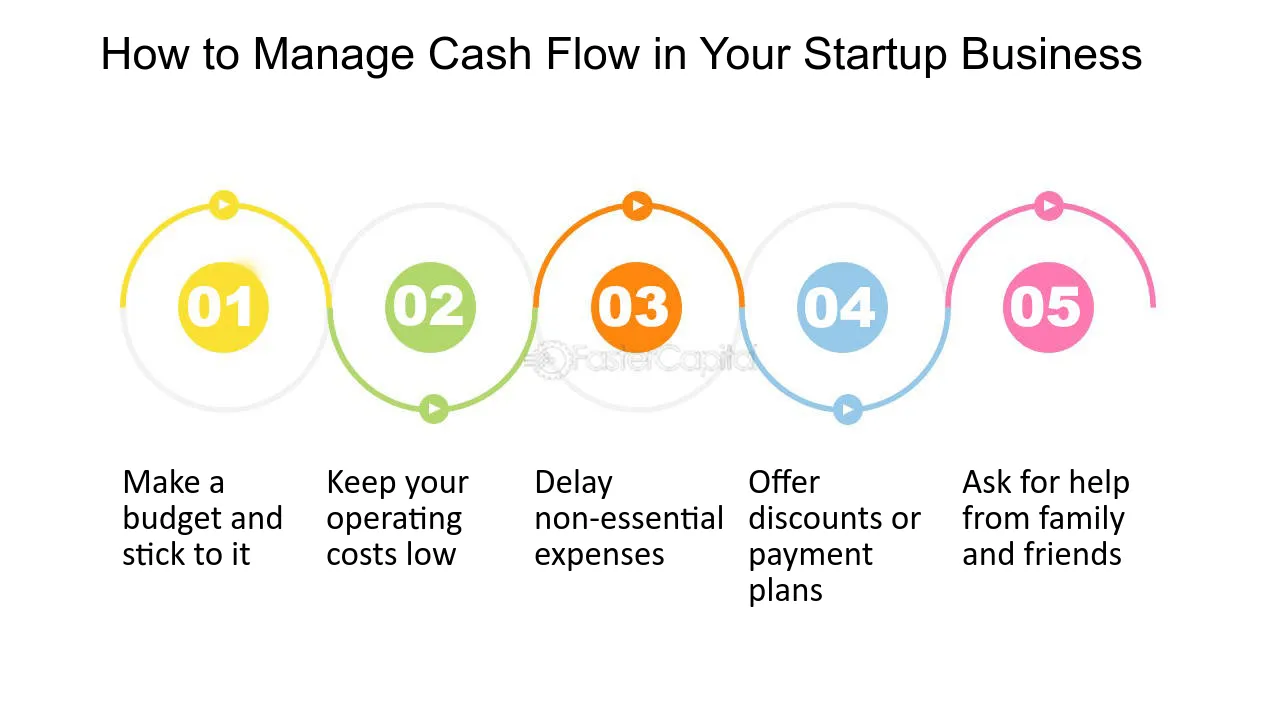

Create a budget and track results

“A budget will ensure you have the financial resources available to fund your business’s growth,” says Gibson.

“It is also a good way to keep track of the month’s payments, and ensure you stay on track.”

A budget can also be a useful forecasting tool. According to Gibson, looking at past budget inflow and outflow trends can help you forecast any factors that could impact the timing of revenue.

“If you want to easily track your cash flow, it’s important to have separate personal and business bank accounts,” says Gibson.

“It becomes harder to keep track of different personal and business income and expenditure when all funds are combined in the same account.”

It can also mean if someone tries to sue your business, your personal assets could be at risk.

Make it easy for your customers to pay you

From internet payment solutions to EFTPOS terminals, you need to offer options that make the payment process easy for your customers. Who wants to wait for a cheque to be processed?

Another way to speed up collection is by providing customers with incentives, says Gibson, such as a discount for paying on time or encouraging customers to pay on the basis that they can receive reward points.

Keep finding new business

If you’re becoming overwhelmed by cash flow concerns, don’t become stuck and reliant on existing customers or turn opportunities away, advises Gibson.

This is the time to gain new business and grow your incoming revenue.

ANZ’s Business Ready tool can help you achieve your business goals with easy-to-use tools that set your business up for success.

Written by: Thea Christie

This material does not take into account your personal and financial needs and/or circumstances, and you should seek appropriate advice (which may include property, legal, financial and/or taxation advice) before making any decisions or acting on any of the information contained in this material. To the extent permitted by law, all members of the ANZ group of companies disclaim liability or responsibility to any person for any direct or indirect loss or damage that may result from relying on the information contained or this site, or any act, omission or error, by any person in relation to the material contained on this site.