The five things that investors look for in start-ups – StartupSmart

Figures released last year show that Australia is second only to the US when it comes to starting up, with one in 10 Aussies actively involved in starting and running a business.

But when it comes to investing in our start-ups, we are lagging well behind our American counterparts.

While venture capitalists claim to be interested in fresh new businesses, the figures show just a trickle of money is available. Freelancer.com founder Matt Barrie recently claimed that Australia will suffer a start-up “brain drain” to the US if the situation didn’t improve.

However, the news is not all doom and gloom. A number of start-up seed funds and incubators, such as Startmate and AngelCube, have emerged in recent years to provide vital seed funding for start-ups.

Throw in a decent number of wealthy individuals who are keen to back innovation and it’s clear that there is still plenty of money available for the right start-ups.

But it’s tough to lure cash from an investor; which is why StartupSmart, in conjunction with Small Business Festival Victoria, is holding this FREE webinar to help boost your chances.

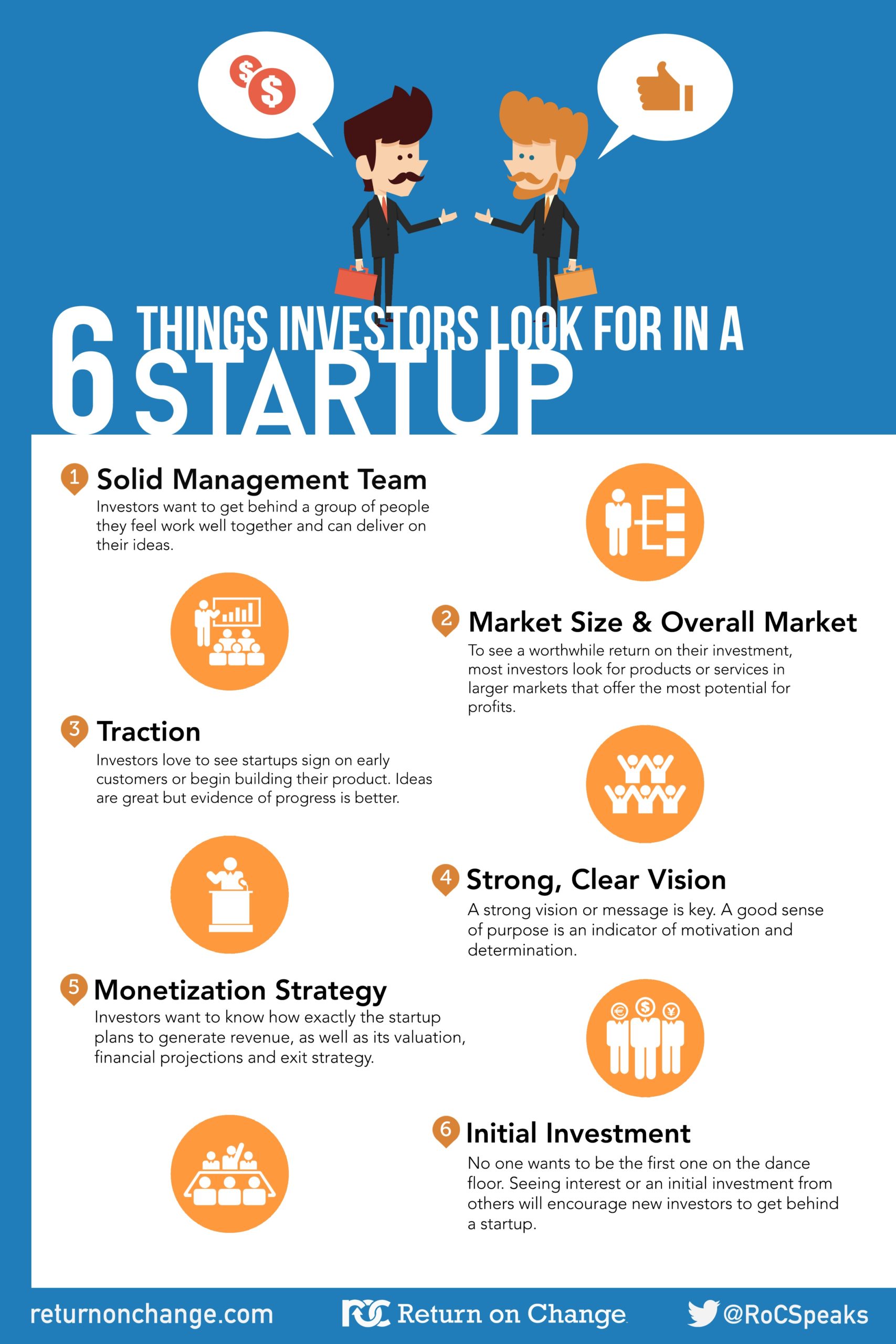

The webinar, presented by Philip Alexander, executive director at Venture Advisory, will reveal the five key things that investors look for in start-ups.

Are they after solid revenue or strong teams? Do they care if you’ve failed in the past? And do you need lots of customers under your belt before they part with their cash? Alexander will give you the lowdown.