Are credit cards a good way to fund my business? – StartupSmart

We hear of many stories from Silicon Valley of start-ups getting millions in venture capital, but the reality for most start-ups is you are going to have to fund your early days with your own money.

Credit cards can be a risky way to finance your business, but if managed correctly, they could also be a great help.

They can help you bridge the gap from raising capital through to achieving positive cashflow.

Despite the risks involved, many entrepreneurs have no other choice but to fund their start-up with a credit card.

There are so many options available, it can be confusing as to which is the right credit card for you. The biggest thing you need to realise is this: If you are sure you’re not going to repay your balance every month, get a low interest credit card.

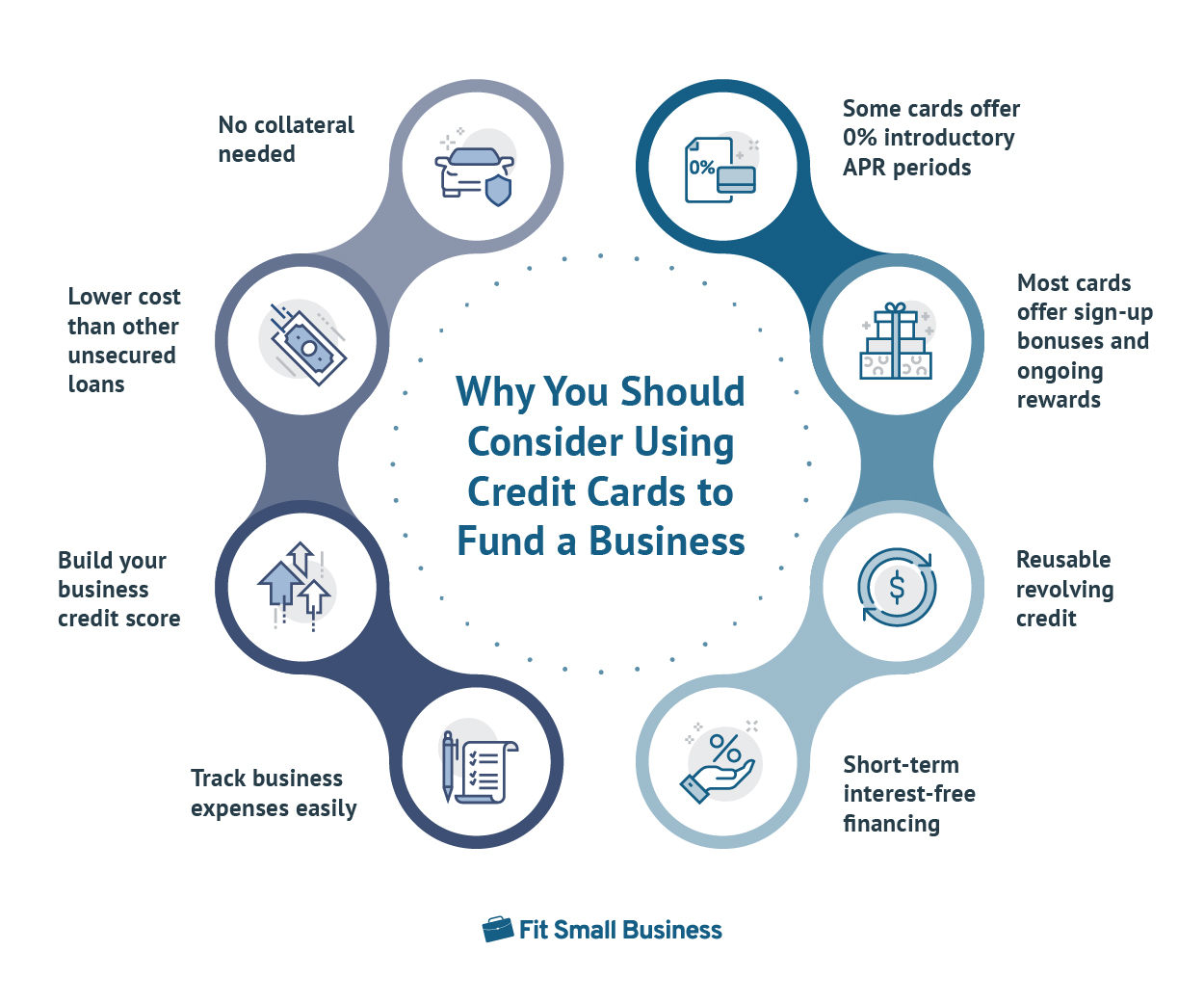

Why is a credit card a good idea?

Even bearing in mind the risks, credit cards can be an ideal way to get your start-up running. Here’s why:

- The application process is much simpler with fewer requirements to commercial finance options.

- A credit card can help you buy the things you need from day one. Getting the right tools and equipment to help improve productivity and assist in earning revenue, will help give your business a better chance of success.

- If you have an existing credit card, you can look into getting a credit limit increase to help get the initial funds you need for your start-up.

- Credit cards allow you to redraw funds after you’ve made repayments. This is a good thing, and a bad thing. It can help with cashflow, but if you’re not careful you could end up in a bad cycle where you don’t repay your balance each month.

Key factors in choosing a credit card for your start-up

- You don’t need a dedicated business credit card.

A personal credit card is fine so long as you separate your personal purchases from business purchases. More often than not, a personal credit card is actually going to be much more cost-effective for you with a lower purchase rate and annual fee.

- Take advantage of 0% purchase offers.

For many start-ups, the majority of your initial purchases are going to be for asset acquisition – buying things like computers, printers, mobile phones or any other office equipment your business might need to be up and running.

There are a number of credit cards available that allow you to make a purchase and pay 0% interest. This can be helpful, so long as you make sure you have repaid your purchases within the “honeymoon” period.

- Do an online credit card comparison first.

You don’t need to show any loyalty to your current bank. In most cases, it won’t give you any benefit applying with your existing bank, so I strongly encourage doing an online credit card comparison before making the decision to do that.

If you compare credit cards, you might find that a competing bank has a much more competitive offer.

Managing your credit card

- “The most powerful force in the universe is compound interest” – Albert Einstein.

Fifty dollars can be extremely powerful. On a credit card balance of $3,000 with an interest rate of 18%, you’d be looking at taking up to eight years to repay that balance if you had just made the 2% minimum repayment each month.

If you pay an extra $50 each month, you could repay that debt within three years, shaving five years off, and saving around $1,800 in interest repayments.

- Treat it as a short term solution for funding.

Using credit cards to fund your daily operations should only be treated as a short-term solution.

It should be your priority to organise a more suitable financing arrangement for your business, once you have a track-record for your business.

- Consider balance transfer offers.

If you’ve racked up a debt on your card, and you are struggling to make more than the minimum repayment, a balance transfer offer could be for you.

Essentially, a balance transfer allows you to transfer your existing balance to a new credit card, with a special rate applied for a certain period of time. There are a number of balance transfer options including 0% p.a. for six month offers and 2.9% p.a. for 12 months.

When it comes to choosing your balance transfer option, you have to be realistic and ask yourself if you’ll be able to pay your balance off in the introductory period, otherwise you could be stuck paying a much higher interest rate. Some cards revert to the purchase rate, and others to the cash advance rate so you’ll need to check the terms and conditions when applying. It’s also important to cancel the other credit card as soon as the balance transfer is done.

With some financial diligence you can make a credit card work for you, instead of you working for your credit card. Picking a great low interest offer, and following a repayment plan will help keep your credit card under control.