What are the costs involved with importing products from China? – StartupSmart

I’m looking to import home decor products from China. What are the approximate costs involved in importing products from China, including things like container freight shipping, insurance, duties, etc?

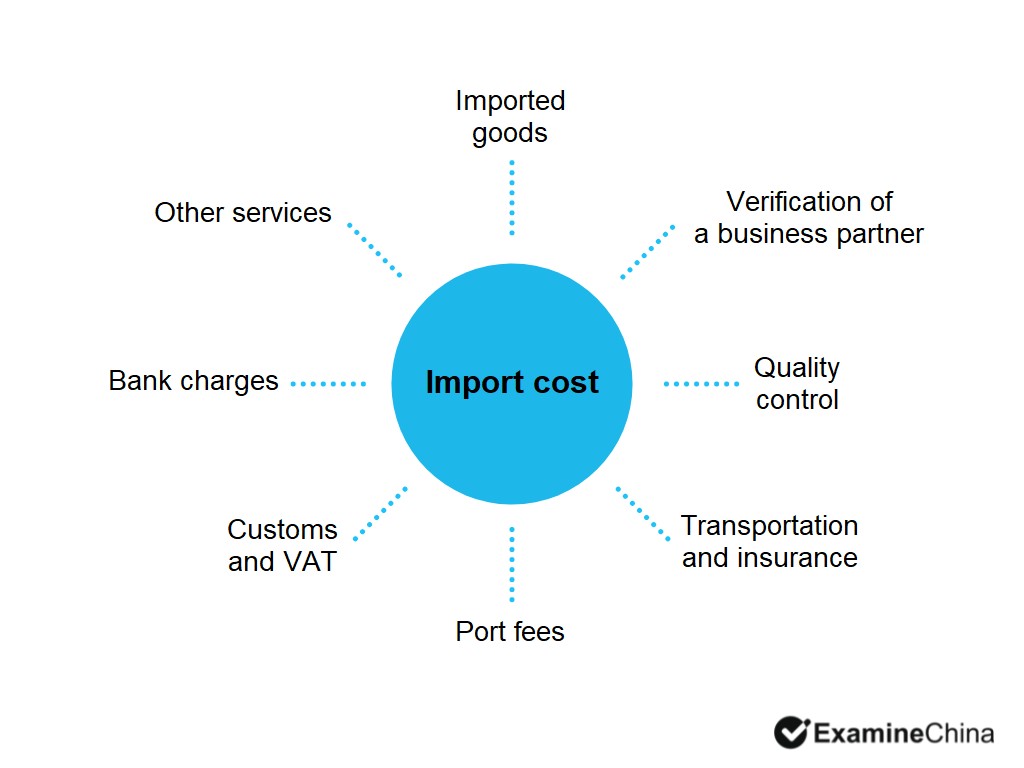

There are many costs involved when importing products from China and these should be well understood to ensure you have a clear insight into what your actual “landed cost” price of a product is by the time it arrives in your warehouse in Australia.

It is integral to understand the estimated landed costs, so that you can price your products appropriately and with sufficient margins to run a profitable business.

For example, a home décor product with a cost price from a China factory of $US100 may end up as a landed cost in Australia of $A140-$160 depending on many factors.

So what are the costs involved when importing from China that affect the total landed cost? The main costs include the size of the products, the container shipping costs, container cartage costs (i.e. getting the containers from the port to your warehouse), insurance, duties and GST.

A shipping container charged out by your freight company will cost you approximately $3,000 for a 20” container and up to $5,000 for a 40” container.

To get your container from the port to your warehouse (known as ‘cartage’ costs) will set you back approximately $550 per container. Marine insurance is also recommended – as we have seen recently with the container ship Rena that perched itself on a reef off New Zealand – and this will set you back approximately 2% to 4% of your shipment value.

Topping the charges out is the government’s share of taxes and duties, with duty being charged at 5% of the total value of the order and GST is charged at 10% of the total value of the order.

But the big one you do not want to ignore is currency fluctuations! In the past month or two, the Aussie dollar has dropped from a high of $US1.10 to 94 cents.

This means the cost of importing that same product has just increased considerably. So you need to price your products with some flexibility to allow for currency fluctuations!

Once all factors are taken into consideration, you can calculate prices and consider whether you are able to compete in the market, and then whether you can profit and grow.