Do I charge my overseas clients GST on consulting services? – StartupSmart

I have started consulting and clients are in both Australia and Singapore. I’m unsure whether GST should be applied to clients outside of Australia.

Currently I’m not registered for GST in Australia, but will need to in 2013 once income exceeds the $75,000 threshold. What should I do?

The Goods and Services Tax (GST) was introduced and made effective in Australia from July 1, 2000. GST applies at the rate of 10% on the supply of most goods, services and anything else, including importations, consumed in Australia after July 1, 2000.

Determining GST application is largely dependent on the type of supply made. Supplies will be either:

- Taxable supplies: GST is payable on these supplies.

- GST-free supplies: No GST is payable on these supplies.

- Input-taxed supplies: No GST is payable on these supplies.

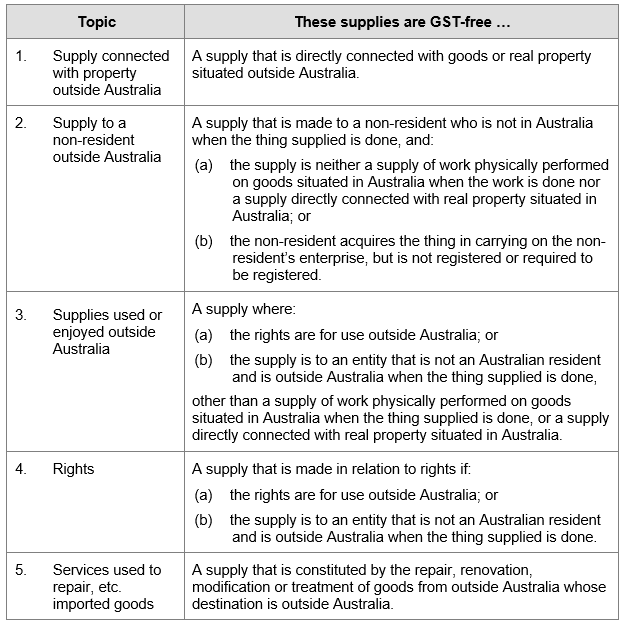

Exports of goods and services for consumption outside Australia generally fall into the GST-free supplies category.

Technically, for goods to be consumed outside of Australia, they must be physically transported out of Australia. However, according to your query, you are supplying things ‘other than goods or property’ i.e. services.

The supply of service for consumption outside of Australia may be GST-free if certain criteria are met. The conditions which must be satisfied include:

- that the recipient is not in Australia when the services are supplied or performed (this condition includes consideration of whether the recipient has any offices in Australia and if so the nature of those offices);

- that the effective use or enjoyment must occur outside Australia (this condition includes considering whether employees of the recipient making use of the services provided are in Australia at the time of making use of those services);

- that the supply of services is not for work performed on any tangible personal property based in Australia; and

- that the supply is not connected with real property in Australia.

As is with all things law and tax, the devil is in the detail. As such, it would not be wise to make any assumptions about the nature of the services provided nor their GST-free status.

To arrive at an accurate and more definitive conclusion, I would recommend seeking a specific transactional review by a qualified tax professional.